Forex Trading is the largest business in the world. I’ve done my research on what will be the best way to answer this important question “How to trade Forex?”. After developing and testing so many bots for my clients on this topic. I come to a conclusion. There are only a few types of strategies out there and most people are using the same approach repeatedly and slightly from a different angle. so, you need to have 3 things in alignment

- Right Forex Strategy

- Right Analysis at Right Time

- Right Mindset

Most people already have a strategy but they are lacking in the other department. if you’re doing the same mistakes repeatedly.

- using Right Strategy with wrong analysis will end up lossing

- if your mindset is not right, and everything else is OK. means you’re not putting the effort that requires.

1. Right forex Strategy

A trading strategy is an approach that decides the right action at right time, where to enter and where to exit the trade, and strategy will decide what should be the right position sizing.

you need to focus on

- the dropdown factor

- stop loss to take profit ratio (TP : SL)

- win to loss ratio (Win : Loss)

Those Strategies that have a high win rate usually tend to give a high dropdown level as well. Note, the win rate is directly proportional to the dropdown.

Win Rate ∝ DropDown Level

And if you’re not the kind of person, who can digest high DropDown Factor/high risk. and your focus is to stay longer in the game by managing your risk. so to reduce your dropdown factor you need to compromise with the win Rate.

what is the win Rate? (win : Loss) or (win to loss Rate)

simply win rate is identifying how many trades you have successfully won out of your total trades. for example, you made 100 Total trades per month and if you have 40 trades in Green and 60 trades in Red. so it simply means that your win rate is 40%

what is the profit ratio? (TP : SL) or (profit to loss ratio)

profit ratio simply means how much profit you are going to gain as a result of risking a specific amount of money as Stoploss. for example if you have got a 20 pips TP and 10 pips SL it means your profit ratio is 2 to 1 (2:1 == TP: SL). which is a good profit ratio it means you’re going to lose less but gaining more.

Types of Forex Trading Strategies

There are tons of different strategies out there, I’m dividing them into 4 different categories based on their trading approach. so that you can understand it better. some of them are meant to be safe and some of them are meant to be risky.

4 types of trading strategies are mentioned below

- Martingale based approach

- DCA based approach

- Hedging based approach

- SingleTrade – based upon (TP : SL) & (Win : Loss) Ratio

which strategy is Best for you?

Hope you’ve gone through the strategic approaches mentioned above. few of them are risky and few of them are following a secure systematic approach. anyhow even we know that trading is not safe, But on the other hand, it’s also the easiest or hardest way to make money at the same time.

it totally depends upon your personality type, Risk digestion capacity, and your mindset and way of thinking that which type of trading approach suits you.

I think there are two different scenarios to decide, which one is best for you?

scenario 1

if you’re the type of person who gives more priority to the high win rate then dropdown.

it means Martingale, Hedging & DCA could be the better choices for you. But keep it in mind with that win rate advantage 80% to 90% of your trades will win but if that 1 or 2 bad scenario occurs. they could eat 40% to 80% of your account or even the whole account. because of the high dropdown factor of your account. you could quickly become rich or you could quickly come back to zero who knows. I wish you the best of luck in your career. don’t stop yourself in your life take risks and learn from your mistakes which could be a great gain for you.

scenario 2

And if you give more priority to managing low dropdown than the high win rate. so it means you would like to stay longer in the game. rather than making a huge profit. that could be an important point. so single trade at a time could be the better choice for you.

to improve your profit capacity focus on Risk management, (win: loss) ratio, and (TP: SL) ratio. make your portfolio to keep a track record of all your historical trades, whenever you take a position note is why you’re executing your trade and what makes you feel you should open a trade there.

Analyze your actions with the help of your portfolio. consistently try to avoid historical mistakes.

2. Right Analysis at Right Time

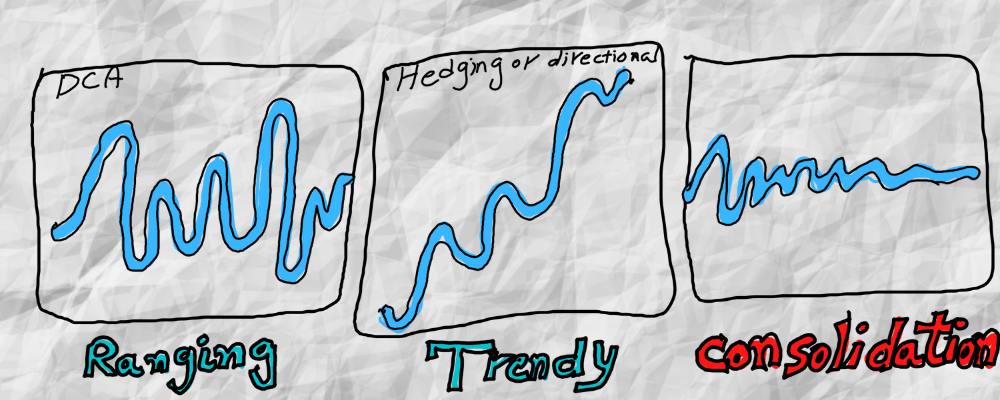

Types of Market phase

the way I look at the market, I made my conclusion that there are only 3 types of market phases

- Ranging

- Trendy

- Consolidation

and it’s not possible to make money in consolidation. we can only make a profit in the trendy market phase or either ranging market phase.

identify Market phase correctly

that is a challenging part. 1st priority is that we need to identify in which phase our strategy performs better. either ranging or trendy.

- if your strategy works better with Trendy phase then your target is to chase trendy market phase, usually “Hedging based approach” & “SingleTrade – based upon (TP : SL) & (Win : Loss) Ratio” works better with Trendy phase.

- if your strategy works better with ranging phase then your target is to chase trendy market phase, usually “DCA based approach” works better with Ranging phase.

if you try to forcefully gain profit from the trendy phase while your strategy works better with Ranging. or if the strategy works perfect with the trendy phase and tries to mistakenly chase ranging. means you’re going to fall in trouble. you might will you lose your account.

choose the Right currency pair

try to understand the nature of currency pair (Symbol) e.g: EURUSD, GBPUSD. each pair has specific nature or style. because these pairs are representing the nature of their country’s performance. And most countries follow a specific pattern, habit. those currencies that are mostly performing as ranging. they are more likely to perform like ranging in the future as well. and those currencies that are mostly performing as trendy. they are more likely to perform like trendy in the future as well. although it’s not a hard rule. But usually, it’s difficult for countries to break their habit/nature so their currencies will perform likely.

3. Right Mindset (How to Trade Forex)

set your Limits and strickly follow them

you must need to decide your max loss per day or per week or per month. and as well as your max profit target per day or per week or per month. After that don't over trade. try to protect your capital.

if you're stressed then avoid trading. because 90% of the time you're not going to make the right decision.

Always use the right lot size for your trades which suits your account better and is less risky. for example if I have a $1000 account I felt secure using 0.02 or 0.01 lot size and it means it's OK for me to use this size that way it's possible for me to risk even 0.5% of my account. if I lose 10 trades in a row it will not affect my account a lot. still, I can stay in the game longer.

don’t fight back against the Market

Itís difficult to find educated people about this topic, but you seem like you know what youíre talking about! Thanks

Yup, cause mostly People are just trying to chase just $ factor through inauthentic ways. Honestly I’m not a Guru just I had done a few bad experiments and that lead me to learn something off of it. And I’m just trying to share my past experience to others so they can capture few important points and we all grow together. I’m just a programmer, not a professional trader.

Thanks for your feedback and sorry for delayed response.

Im very happy to find this website. I wanted to thank you for your time due to this fantastic read!! I definitely savored every part of it and i also have you book-marked to look at new stuff on your website.

pleasure is mine!